Long-Term Care Planning

Explore a wide range of highly rated insurance companies and plan options with our professional long-term care advisors.

Ready for expert recommendations?

Get started >Solutions to fit your needs

If you have assets and are trying to find the right way to protect them from future care costs, long-term care insurance may be a good option for you. Use the resources below to learn about long-term care planning and how you can protect yourself.

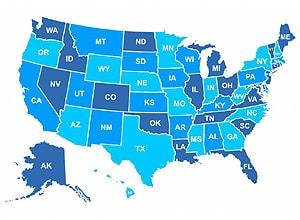

Your State's Long-Term Care Insurance Plans and Costs

Long-term care insurance policies and companies vary by state.

Learn More >Long-Term Care Planning: Professional Guidance

Understand plan design, health qualification, product and company selection.

Learn More >What Disqualifies You From Long-Term Care Insurance?

Find out if you can qualify for LTC insurance using our pre-screen form.

Learn More >Long-Term Care Insurance Cost: Advice for Lower Premiums

Savvy buyers use these methods to obtain affordable long-term care insurance premiums.

Learn More >1035 Exchange Life Insurance and Annuities for LTCi

Tax law allows you to exchange existing insurance for hybrid long-term care insurance.

Learn More >Is Long-Term Care Insurance Tax Deductible?

Deductions for long-term care insurance premiums can be significant.

Learn More >We think you might like:

What is Long-Term Care?

An overview of what it is, who needs it, where it’s received, and the average length of care for men and women.

Learn More >National Long-Term Care Costs

Get a better understanding of how much risk you might want to transfer to an insurance company.

Learn More >Frequently Asked Questions

Find answers to the most commonly asked questions about long-term care planning and LTC insurance.

Get Answers >